- When Science Meets Crime: The Rise of BioTech Fraud in China - April 22, 2025

- How Sports Betting Is Fueling a New Era of Crime Networks - April 10, 2025

- The Dark Side of Influencer Parenting: The Case of Ruby Franke - April 8, 2025

Understanding Tariffs and Their Purpose

Tariffs are essentially taxes that governments impose on imported goods. Their primary aim is to protect domestic industries by making foreign products more expensive, nudging consumers to opt for local alternatives. This seems straightforward, but the complexity arises in the ripple effects tariffs can have. While they may boost local businesses initially, tariffs can inadvertently become a breeding ground for illegal activities. For instance, businesses might resort to smuggling to avoid these taxes, resulting in substantial revenue losses for governments. This not only affects the economy but also poses risks to consumers, as smuggled goods often bypass safety regulations.

The Rise of Smuggling Operations

As tariffs climb, the incentive for smuggling escalates. The International Chamber of Commerce reported that the global trade in counterfeit and pirated goods is valued at an astounding $509 billion annually. Smugglers capitalize on high tariffs by sneaking goods into countries illegally, which undermines legitimate businesses and often leads to job losses. This illicit trade doesn’t just have economic repercussions; it also poses significant safety risks. Smuggled goods frequently fail to meet safety standards, potentially endangering consumers.

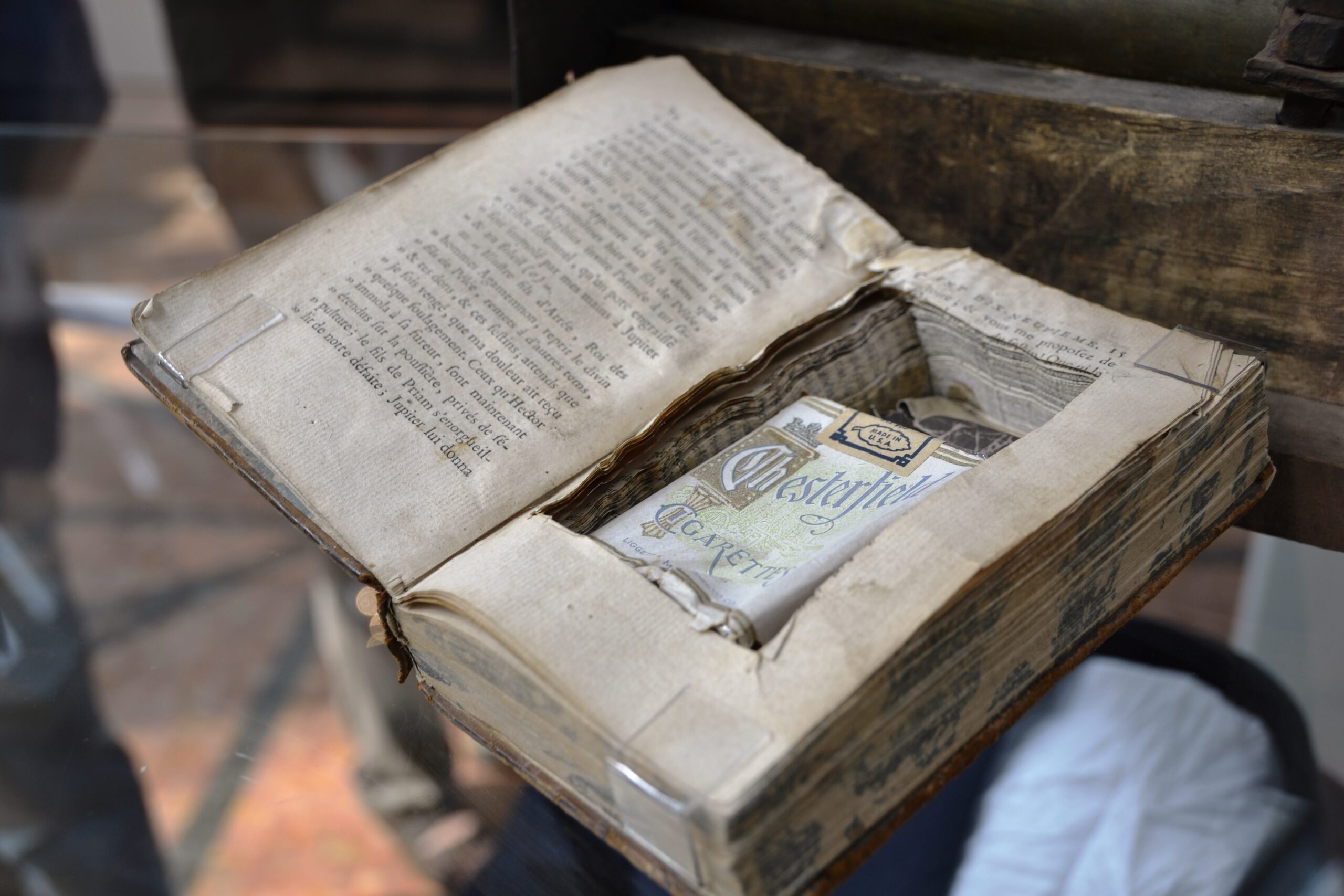

Case Studies of Tariff-Related Crimes

Numerous high-profile cases highlight the criminal activities tied to tariffs. In 2021, U.S. authorities seized counterfeit goods worth over $1 billion, including luxury items and electronics. These goods were primarily smuggled in to avoid tariffs, showcasing the magnitude of the issue. Such operations generally involve organized crime syndicates employing sophisticated methods to transport and distribute illegal goods. This level of organization makes it challenging for authorities to combat these activities effectively.

The Impact on Domestic Industries

High tariffs can create a deceptive sense of security for domestic industries, leading to complacency. Companies might lean on tariff protection rather than striving for innovation and quality. Research from the Peterson Institute for International Economics indicates that while tariffs may protect jobs temporarily, they can harm industries in the long run by stifling competitiveness. This lack of competition can result in lower-quality products and services, ultimately hurting consumers and the economy.

Corruption and Bribery

The enforcement of tariffs can also foster corruption and bribery among customs officials and law enforcement. In some regions, businesses may resort to bribing officials to dodge tariffs or facilitate the smuggling of goods. Transparency International’s Corruption Perceptions Index highlights that countries with high tariffs often experience elevated levels of corruption. The financial stakes involved in tariffs create opportunities for illicit behavior, further complicating efforts to enforce them effectively.

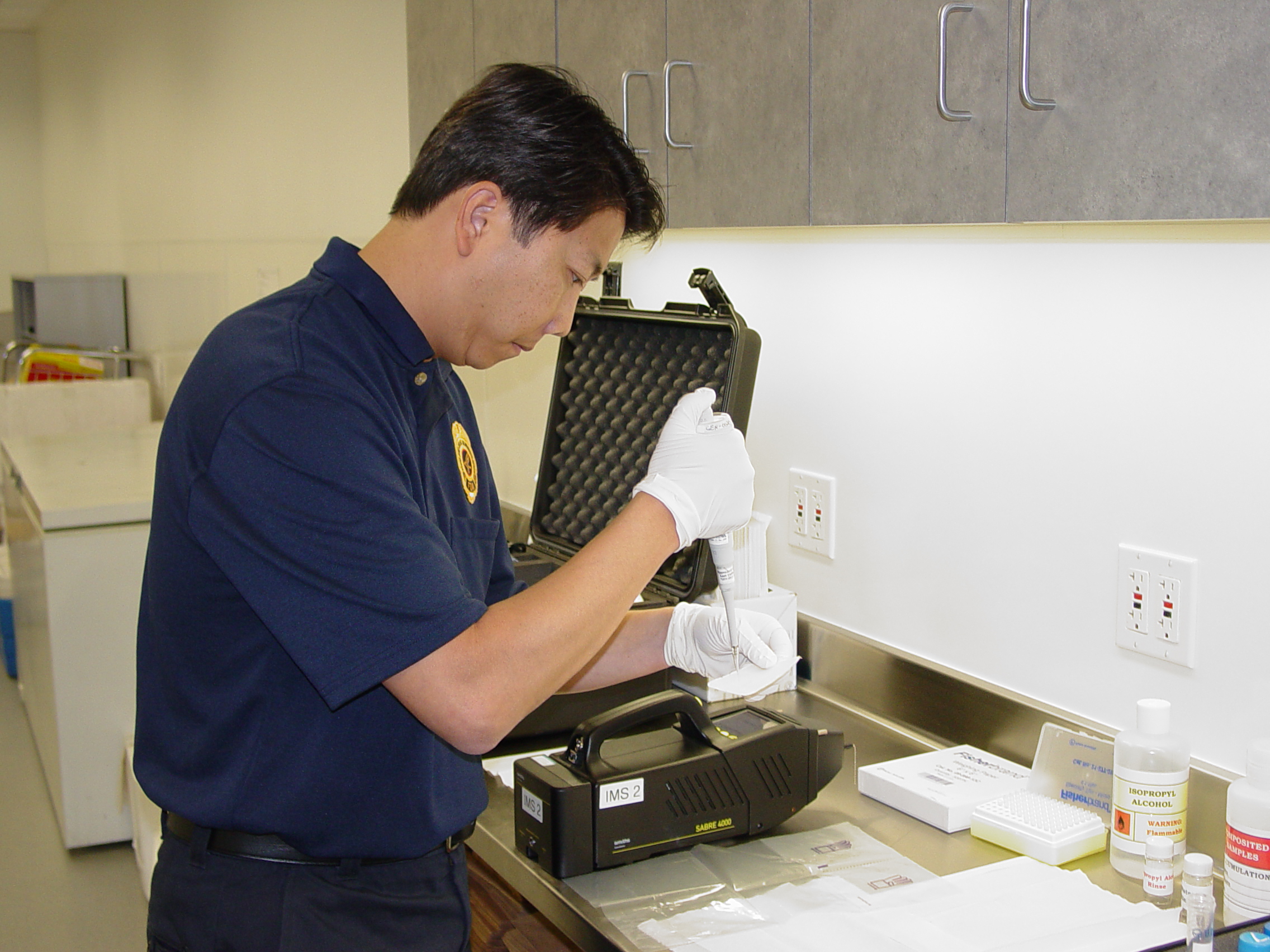

The Role of Technology in Tariff Evasion

Technological advancements have simplified tariff evasion for criminals. Online marketplaces and dark web platforms enable smugglers to reach consumers directly, bypassing traditional retail channels. A report by the United Nations Office on Drugs and Crime (UNODC) shows that the rise of e-commerce has significantly increased the volume of smuggled goods. This makes it harder for authorities to track and regulate these activities, highlighting the need for improved technological solutions in law enforcement.

International Responses to Tariff-Related Crimes

Governments worldwide are beginning to recognize the importance of international cooperation in combating tariff-related crimes. Initiatives like the World Customs Organization’s (WCO) Framework of Standards to Secure and Facilitate Global Trade aim to enhance customs enforcement and reduce smuggling. Collaborative efforts between countries can boost intelligence sharing and improve enforcement capabilities, making it harder for criminals to exploit trade barriers.

The Economic Cost of Tariff Evasion

The economic impact of tariff evasion is substantial. The World Bank estimates that countries lose billions in revenue due to smuggling and other forms of tariff evasion. This loss of revenue can lead to budget shortfalls, affecting public services and infrastructure development. Additionally, legitimate businesses face unfair competition from smugglers who don’t adhere to regulations, further straining the economy.

Consumer Risks and Safety Concerns

Consumers also face risks associated with tariff evasion. Smuggled goods might not meet safety standards, posing health risks to consumers. For example, counterfeit pharmaceuticals can have severe health consequences. The U.S. Food and Drug Administration (FDA) has reported numerous cases of counterfeit drugs entering the market, underscoring the dangers of unregulated products. These risks highlight the need for stricter enforcement and consumer awareness.

Future Implications and Solutions

As global trade continues to evolve, the challenges posed by tariffs and related criminal activities will persist. Policymakers must consider the broader implications of tariffs and explore alternative solutions that promote fair trade without encouraging criminal behavior. Strategies such as reducing tariff rates, enhancing customs enforcement, and fostering international cooperation can help mitigate the dark side of tariffs.